- Automatic document identification.

- Real-time verification and validation of identify documents (+200 countries covered)

- PPE & sanctions

- Automatic recognition of documents in few seconds

- Advanced revenue analysis

- Guaranteed receipt of a 100% complete and up-to-date file

- Automatic data enrichment via external database

- Check of the authenticity of the supporting documents

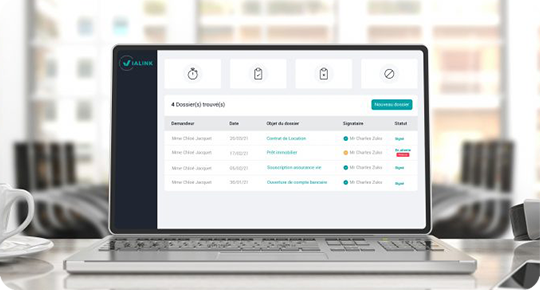

- Simplified signing of contracts, amendments, documents, etc.

- Follow-up of the validation process and of the signatories.

- Automated management of the signature process (location of the signature, order of documents, management of the multi-signatory process, etc.)