The emergence of neobanks shows the need for an immediate, simple and personalized way of consumption. Traditional banking institutions need support for this digital transition.

Acquiring smart tools is an additional source of competitiveness, performance and above all an optimal response to the new regulatory challenges of the banking sector.

VIALINK answer

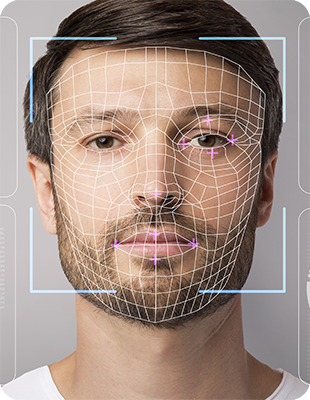

Thanks to facial recognition and passive liveness detection coupled with documentary verification, you can be sure you are dealing with people you can trust. VIALINK offers an optimized customer knowledge process (KYC/KYB) in compliance with the regulatory obligations in force.

VIALINK answer

VIALINK 360 is a platform that speeds up the process without any disruption. It takes only 5 minutes to collect data and contract with confidence.

Digitization allows teams to dedicate themselves to client advice and think about ultra-personalized formulas according to the issues (assets, financial management, structuring of complex financing, etc.). In agencies or online, give your clients time by providing them with high-quality tools and advice.

Automation reduces file processing times and brings full satisfaction to your customers thanks to solutions that adapt to their lifestyle.

The implementation of a digitalization process considerably minimizes the risks of fraud and non-compliance.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | 12 months | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |